Bank Customer Touch Point Matrix 4/2012

Summary

Facebook, Twitter and mobile devices like smartphones and tablets are new, powerful communication and access channels. Many banks are still operating in organizational and technical silos. Besides a lack of understanding of customer behaviour the banks also lack about the smooth interplay of the various communication and access channels from the perspective of their customers. The example of mortgage shows how banks could position themselves early on in customer experience. A smooth combination of QR Code, iPad, new presentation technology at the branch, video conferencing and Internet shows how customers could experience a premium banking service. The Bank Customer Touch Point Matrix helps banks to formulate such worlds of experience systematically.

New Bank Customer Access & Communication Channels

Facebook will soon have more than one billion active users worldwide. 50 percent of them log in daily. An average user is connected to 80 pages, groups or events, and publishes about 90 contents per month. Worldwide, every month more than 30 billion contents are shared. More than 250 million users access Facebook with their mobile devices (smartphones, tablets, etc.). The mobile users are twice as active as others.

Twitter has now reached a similarly high level of awareness such as Facebook.

Today, more than 200 million users send more than 200 million daily tweets (140 character messages), more than half of them with mobile devices.

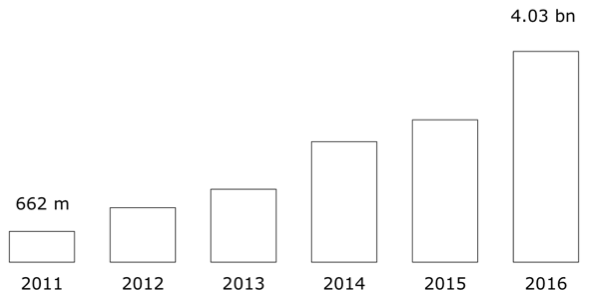

At the same time the number of Internet-enabled mobile devices explodes from 662 million in 2011 to more than four billion in 2016.

Communication and Access Channel Silos in Banks

In addition to branch, call center, self-service devices, Internet, newspaper, TV and radio there are now Facebook, Twitter and new mobile devices. In the future the new communication and access channels will gain great importance in the banking industry. So far, the communication and access channels are organizationally and technically widely viewed and treated as silos by banks.

The marketing department is responsible for the Internet, newspaper, TV and radio, the product management department for branch, call center and self-service and finally the business development department for the new mobile devices. The modern IT departments are directed accordingly to organizational and technical structures of the business departments. To date, collaboration between communication and access channels can hardly be recognized from a customer perspective. The largely poor communication and cooperation between the business departments and the IT departments increase the problem.

Lack of Understanding of Customer Behaviour

It applies for most banks that an interaction that starts in one channel, such as a mortgage advice at the branch, cannot be continued in another channel, e.g. Call Center. If a customer still has a question after the mortgage advice at the branch and reaches out to the call center often the call center agent has no information about the meeting and discussion at the branch. In most cases, the conversation will end by pointing out that the bank calls the customer back. Or, the consultation will take place again - with even more data collection and sometimes with a different recommendation. The same applies for an investment simulation a customer starts on the Internet and wants to continue at the branch. Or an account opening request, started in the call center, continued at the branch and completed on the Internet.

The examples listed here demonstrate insufficient organizational and technical support of the banks.

Obviously, the banks lack an understanding of the proper interplay of the various communication and access channels from a customer perspective.

Example: Mortgage

Quite often a conversation does not resolve all issues. The financing of a house is much discussion – with your partner, parents and parents in law, and often with good friends or other persons of trust. This mostly results in new questions that you would like to clarify with your bank. An example would be the issue of early repayment. However, it is very expensive if you have to go to the branch to clarify any further question.

From a technological and organizational point of view banks could offer such services. Customers should expect premium banks to deliver such experiences.

Also, banks could better support the signing of the contract.

Once all questions have been clarified and all offers have been reviewed banks make it often unnecessarily hard to get to the contract. A majority of customers take their time between the offer and the signing of the contract. In this step, the banks lose a part of the business. One reason is that the banks force their customers to go to the branch to sign the contract. Though, it would be possible to close the contract online via the Internet. This would be beneficial for the customer and the bank. Once a decision has been made by the customer the signing of the contract could be completed at any time and anywhere.

Bank Customer Touch Point Matrix

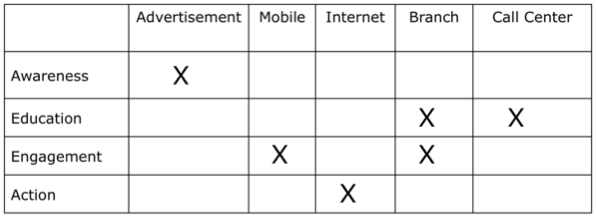

In the future, it will be crucial for banks to develop, implement and deliver such scenarios, in order to position themselves early on in the worlds of customer experience. A systematic approach along the following Bank Customer Touch Point Matrix is recommended.

Bank Customer Touch Point Matrix