Summary

Banks in Germany spend about 12 to 15 billion Euro on IT, annually. This is a great opportunity for foreign IT companies.

There are 8 steps to enter the German Market for Banking IT:

-

1.Be aware of local mega trends

-

2.Identify target banks

-

3.Define the operating model

-

4.Adapt IT products and IT services to local needs

-

5.Position the company and offering

-

6.Understand the German culture

-

7.Approach target customers

-

8.Win customers

The market opportunity

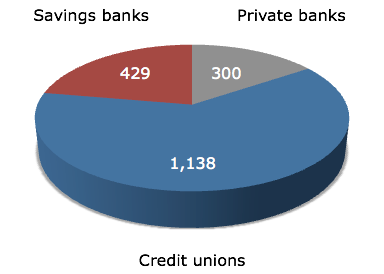

Germany is the largest economy in Europe and the second most populated nation with more than 81 million people. There are about 2,000 banks in Germany with currently more than 650,000 employees. The German banking market is divided into three major segments:

Number of banks in Germany, Source: Deutsche Bundesbank

According to Ovum, IDC and BITKOM banks in Germany spend about 12 to 15 billion Euro on IT, annually.

Market entry in 8 Steps

Step 1: Be aware of Mega Trends

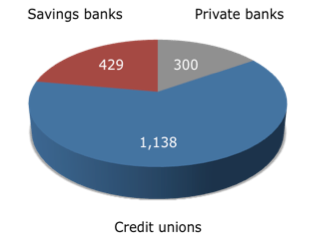

Mega Trends are changing the way we learn, work and live. While there are some global mega trends in banking like the increase of regulatory requirements on banks, there are many mega trends in banking and IT that differ significantly from region to region and from country to country. E.g. in some Asian countries and Northern Europe mobile banking is a mature and widely used access channel while in Germany mobile banking is at an early stage of development.

In order to position products and services timely an awareness of mega trends in the German banking industry is indispensable.

It is recommended to create a trend radar for the German Banking IT market.

Step 2: Identify target banks

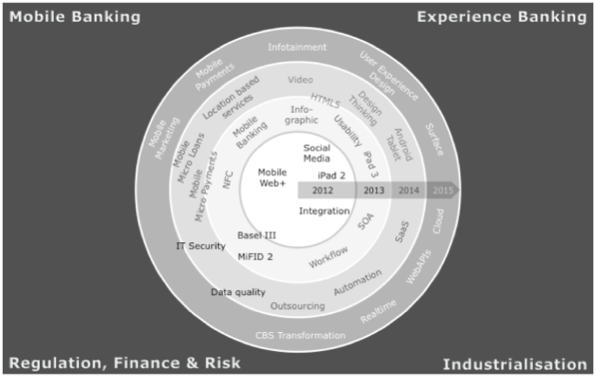

Compared to other countries the German banking market is still very fragmented. Almost 2,000 banks compete against each other. The private bank sector comprises about 300 banks in 2011. The three largest private banks are universal banks with more than 35 million retail banking customers. Most of the other private banks in Germany are highly specialized with a reduced but focussed set of products, services and access channels.

Segmentation of private banks in Germany, December 2011; Source: Deutsche Bundesbank

Given the structure of the German banking market the needs for IT products and IT services differ significantly from bank to bank. Therefore it is essential to segment all banks in Germany against the IT product or IT service offering.

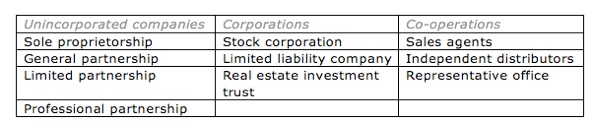

Step 3: Define the operating model

Supposed Germany is an attractive market with great opportunities for an IT or IT service company it is important to choose the appropriate operating model for market entry.

The identification of the appropriate operating model is dependent on size, structure, amount of investment and entrepreneurial appetite.

Regardless of the operating model it is recommended to test the German market first in order to gain insight and experiences before setting up operations. A road show organised and performed by German seasoned banking industry professionals is a first step to test the market. Compared to setting up an own office and hiring German banking IT professionals a road show is a risk free and low cost investment with great personal insight at first hand.

Step 4: Adapt IT products and IT services to local needs

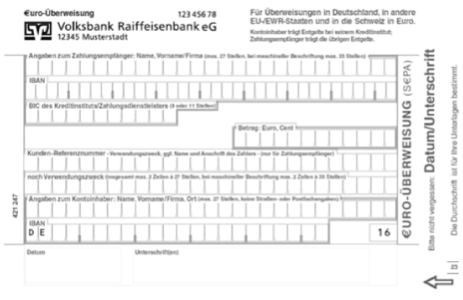

The insight and experience gained may lead to adaptation needs of the IT products and IT services to the German banking market. Besides the German language there are often German regulatory requirements and local bank customer habits to meet. E.g. German bank customers do not make use of checks to pay their invoices. Instead of checks Germans’ make use of standing orders, money transfers or direct debits. Another speciality of the German banking market is the preference for deposit products instead of stocks and funds.

Example of a German money transfer template

Step 5: Position the company and offering

To enter the German market for Banking IT successfully the foreign IT company must offer an unique selling point (USP). Amongst others, Banking IT innovations, low cost Banking IT services or high quality Banking IT products are suitable USPs. At the beginning it is recommended to focus the market entry efforts on one single offering, e.g. on mobile banking, CRM systems or contact center software for banks.

Be the expert

Given the competition in the German market for Banking IT it is recommented to push the business as the expert. Banks love buying from experts. As an expert you educate the banks about what they should do and why… and then wait for them to reciprocate by picking your offering.

Step 6: Understand the German culture

The business etiquette in the German banking industry can be divided into three essentials:

A) Communication styles

The communication style in German banks is very direct and fact based. German bankers show little emotions and do not use coded language and humour. As a rule of thumb, the more serious the situation, the more seriousness is requested.

B) Meetings and negotiations

German banks expect well planned and prepared meetings.

When arranging meetings, appointments are mandatory and should be made several weeks in advance. Prior to an actual meeting, often a considerable amount of preparation was done to support the debate. Documents should always be in German.

Generally meetings follow a strict agenda, including starting and ending times. Punctuality is very important when having an appointment with the desired German counterpart.

C) Dress code

The German business dress in banks is formal and conservative. For men dark coloured business suits and ties are appropriate. Women either wear a business suit or conservative dress with little or no jewellery or accessories.

Step 7: Approach target customers

Once the target banks are identified and the awareness of the German banking business culture is generated emails and calls are tools to approach the target customers.

Instead of an Email a traditional hand written mail often generates more attention and interest of the recipients.

Still the best places to make contact are banking, IT and banking IT industry fairs, events and conferences.

These activities should be supported by publication of articles at bank, IT and banking IT magazines and online forums like, CIO, GI, Bankmagazin, Bank Information, Handelsblatt and others.

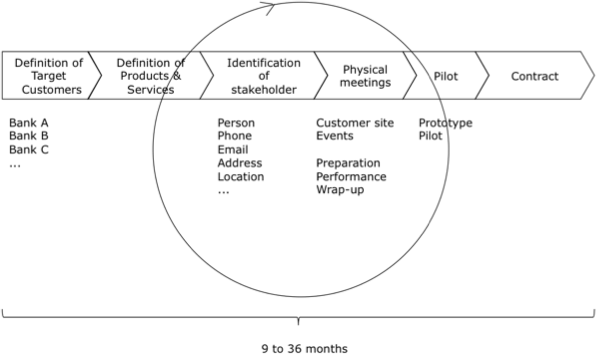

Step 8: Win customers

Patience, perseverance and time are essential in order to win a German bank as a customer. On average it will take between 9 month and three years, dependent on the size of the bank and the kind of IT product or IT service of the respective IT company.

It is crucial to the sales process to show competence. References and case studies will help to demonstrate experience and expertise. But in many situations only tangible prototypes of the respective solution will help to convince the buyers, influencers, gatekeepers, users and decision makers to buy the offering.

About imacor

Amongst others imacor helps International IT Providers to enter the German speaking market for Banking IT.