Future-proof IT Landscapes of Banks 3/2012

Summary

High operating costs, little scope for innovation, too expensive IT projects, functional gaps, low agility, the immature banking IT industry and the lack of scalability are significant weaknesses of today’s IT landscapes of banks. Major causes are redundancies, inconsistencies and unintended dependencies across product lines and access channels as well as a variety of different technologies used. Future-proof IT landscapes of a banks follow nine requirements, e.g. a component-wise structure and decoupled technologies. The Banking Industry Architecture Network (short: BIAN) seems to be a suitable forum to lay foundations for the construction of future-proof IT landscapes of banks.

Significant Weaknesses of IT Landscapes of Banks

In the past 10 years I could gain insight into the IT landscapes of more than 100 banks, globally. For most banks very similar weaknesses are identified:

High operating costs

After personnel costs IT costs are the largest cost position. They count for 10 to 25 percent of the total costs of a bank. The operating and maintenance costs of IT landscapes of banks usually devour up to 75 percent of the available IT budgets. In some cases there are even more than 90 percent.

Little scope for innovation

Increasing regulatory requirements and the limited IT budgets further reduce IT investments of banks. For new developments, such as innovative mobile banking solutions most banks are not willing or not capable to provide IT budgets.

IT projects are too expensive

Where a bank invests in a new product or a new access channel unreasonably high IT costs has been made. For large retail banks, a new savings product often causes IT costs amounting to several million Euros. It hardly pays for these banks to invest in such projects.

Functional gaps

Although many banks have invested for decades in their IT environments many 100 million Euros in places large functional gaps are visible, especially in the loans business and online banking. For example, there are many banks that have to process manually the early repayment of mortgages. And online banking customers of several banks can only transact 30 percent of banking products, compared to the local branch.

Low agility

Even relatively small product and feature enhancements in the IT landscape of a traditional bank today take 18 months or more. Bundled products and advisory services across multiple functional domains, or across channels often fail because of the complexity of the IT implementation.

Immature banking IT industry

Compared to other industries, the vertical integration of banks in the IT is still very high. Many banks are developing their own IT applications and operate a data centre with a vertical of 100 percent. Even the most sophisticated banks still have a vertical of more than 50 percent. In comparison, more mature industries have a greater distribution in the value chain. A car manufacturer limits its vertical integration often to 25 to 35 percent and goes for large parts of the value chain with a strategic partnership.

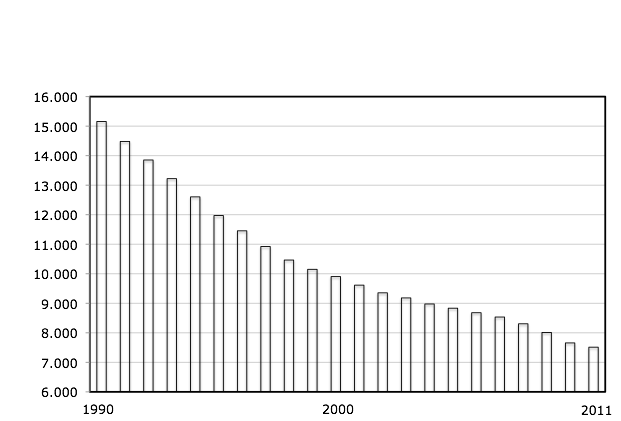

Lack of scalability

Once the number of transactions, statements or the use of individual banking services greatly increases in a short to medium term the underlying IT landscapes of banks come quickly to their performance limits. Usually a disproportionate investment of time and effort is needed to adapt the capacity of the overall system to the new demand. This is particularly evident in takeovers of other banks. Despite of a global consolidation of the banking market for more than 20 years, most IT landscape of banks today are not M & A ready.

Causes of weaknesses of IT landscapes of banks

I see seven reasons for the poor state of the IT landscapes of Banks:

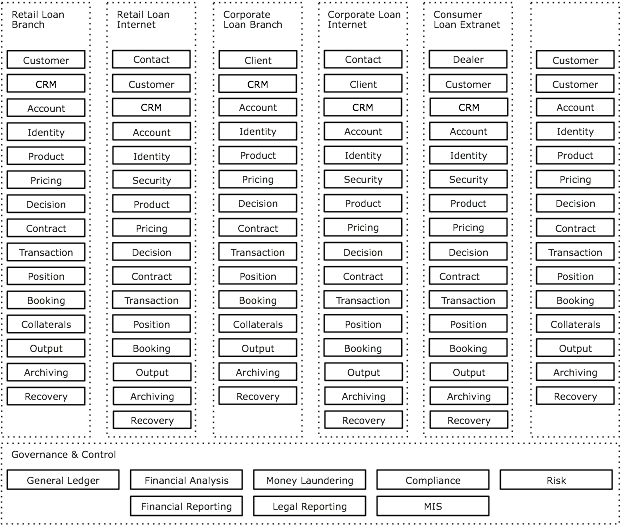

1. Individual banking products are implemented redundant and inconsistent across product lines and across access channels

2. There are unintended dependencies between business logic and technology

3. Unintended dependencies exist within the various layers of technology

4. Overlapping of applications across functionalities

5. The IT landscapes of the banks have too many interfaces, file transfers and point to point connections

6. Too many technologies are used

7. The knowledge about the IT landscape is limited to a few individuals

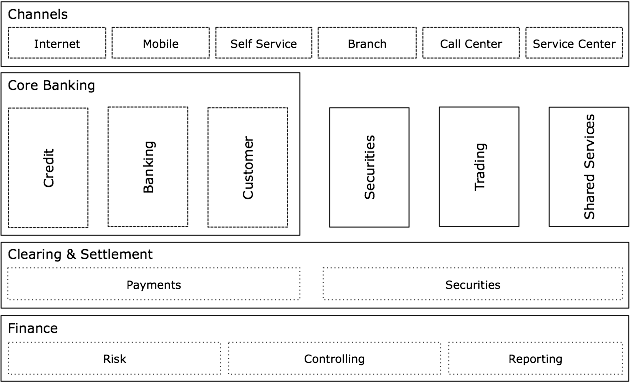

Blueprint of future-proof IT landscapes of banks

A future-proof IT landscape of a bank should reduce the current weaknesses or even eliminate. This requires a new blueprint of the following nine requirements:

1. The banking-related functions are component-wise structured and free of unplanned redundancy

2. The functions are shared across product lines and access channels

3. The IT landscape comprises adaptive workflows that can dynamically distribute work

4. Standard software is used widely

5. Bank functions are implemented consistently across all channels and decoupled from the technology

6. The technology is built up in layers and independent from each other

7. Technology standards are established and enforced

8. There are mainly mature technologies used

9. Cheap, industrialized standard hardware is used

In the future it will be important for banks and their IT providers to closely collaborate and create solutions that meet these new requirements. The Banking Industry Architecture Network (short: BIAN) seems to be a suitable forum to lay foundations for the construction of future-proof IT landscapes of banks.

Appraisal

I like to thank Karthik Krishnamani for his contribution.

Link