How to create great Banking IT Services 5/2012

Summary

To me, a great Banking IT Service is a product or service of a bank, which is largely determined by the use of IT and generates significant benefits for customers and banks. The money transfer functionality in Online Banking, iPads retirement advisory and future simple Cloud Banking Services are great examples of Banking IT Services.

Traditional project approach and functional and technical modelling from the perspective of the bank are significant weaknesses in the construction of Banking IT Services.

Design Thinking and Service Creation are new approaches in the construction of Banking IT Services. Both models focus more strongly on the user, lead more quickly to market launch and are less likely to fail in terms of the expected business value in context of Banking IT Services.

What is a great Banking IT Service?

To me, a great Banking IT Service is a product or service of a bank, which is largely determined by the use of IT and generates significant benefits for customers and banks. An example is the money transfer functionality in Online Banking. This service enables bank customers to do their daily banking transactions at home and reduces the cost for both, customers and banks. The use of iPads in retirement advisory is another impressive Banking IT Service. I am aware of a bank that uses the iPad to impressively illustrate the need for retirement provisioning. The bank was able to double product sales. This was achieved by a well-designed interaction between client, bank advisor and iPad as a highly accomplished interactive presentation medium. Simple Cloud Banking Services that are highly efficient and provide high quality banking processes very inexpensive are examples of great Banking IT Services of the future.

Weakness: projects

Many Banking IT projects take too long, cost too much and do not achieve the desired quality or scope. Countless studies show that impressively, e.g. Standish Group's CHAOS Report or Bent Flyvbjerg’s work on mega projects.

The reasons for this sad picture are various. Ranging from poorly defined requirements, lack of planning to lack of expertise in the implementation. The functional organization structure of banks and silo mentality of departments exacerbate the problem.

Even more important than time delays, cost overruns and poor quality is the lack of commercial success of many banking IT projects.

In my view there are two main reasons for the failure of banking IT projects:

1. Traditional project approach

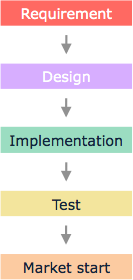

Traditional waterfall model

Still, most of the IT projects in banking are implemented along the traditional waterfall model. First, the requirements are described in a specification. The first step often takes months. Some times even years for major projects. The design is started only when the first step is finished. This second phase often lasts many months. With the completion of the design phase, the implementation is started. The implementation phase will take at least 6 months, often one to two years. In the last step, the work results from the first three stages are tested. Only then the new banking IT service launches on the market.

The main disadvantages of this approach are obvious:

-

✦Some requirements are outdated already at market launch

-

✦Basic errors are noticed by future users only in the test phase

-

✦Overall, this process model takes a long time since starting the next phase only when the previous one is completed

2. Functional and technical modelling from the perspective of the bank

Most banks are developing their Banking IT Services from their own functional and technical perspective. Implemented is what should be made available for customers from a functional point of view and what is technically feasible. Let’s have a look at current mobile banking applications. The mobile apps have exactly the same services as the Internet Banking: Account overview, money transfer, branch finder and ATM finder. New customer benefits and added values are not created. This can be particularly seen from the fact that bank customers are not willing to pay for today's mobile banking apps banks. Other examples include the flopped PC advisory tools for branch advisors to achieve a higher quality in advisory. This kind of Banking IT Services are not developed from the perspective of the bank advisor and without the involvement of bank customers.

Challenge of customer benefits

"If I had asked people what they want they would have said faster horses."

Henry Ford

Most people can not articulate what new products and services they would like from banks. Therefore market research and customer surveys are of limited help to create new Banking IT Services. However, you can ask customers what they think if they can try out a new service.

So what can banks and IT service providers do to build great IT Banking Services?

New approaches

“Insanity is doing the same thing, over and over again,

but expecting different results.”

Albert Einstein

If you want something you’ve never had, you must be willing to do something you’ve never done. This state of mind may be worth it. In the recent years I have gained very good experience with the following methods with respect to the development of new Banking IT Services:

A Design Thinking

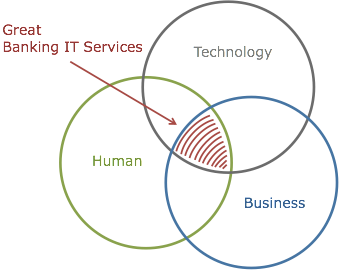

To date, functional and technical modelling is at the centre of current business case considerations. Views from the perspective of the users are usually neglected. Bank advisor and bank customer are involved too late in the development process.

This is where Design Thinking comes into play.

Design Thinking

Design Thinking asks the following questions:

-

✦What is the problem to be solved from a user perspective?

-

✦How do you better facilitate the work of the bank advisors?

-

✦How do you improve the life of bank customers?

Once the user's perspective is understood you start thinking about established and new technologies to solve the challenge and about the business case.

Are humans, technology and business well balanced great Banking IT Services can be created.

And how can we organize the project approach?

B Service Creation

Service Creation

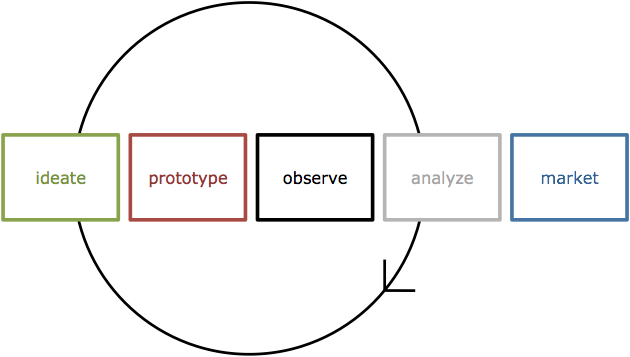

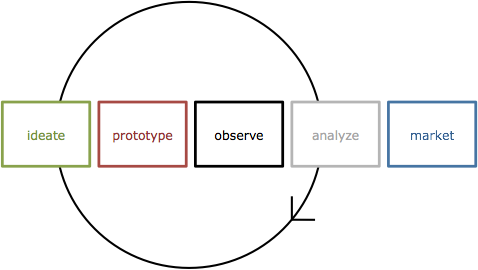

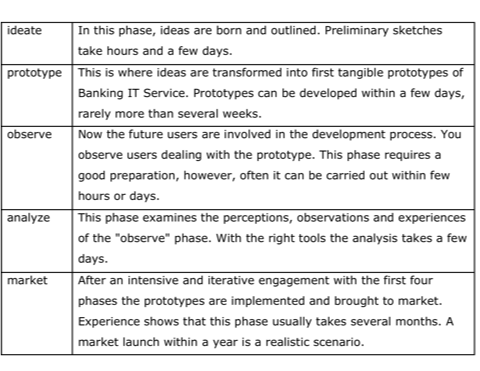

As previously shown, most people can not articulate what new products and services they would like from banks. Therefore, banks and IT service provider need to develop some prototypes of new Banking IT Services first. The model “Service Creation” presented here, I have developed from 8 successful launches of new Banking IT Services of the last 12 years. It draws on the experiences of Design Thinking in other areas.

Conclusion

Compared to the traditional waterfall model the models Design Thinking and Service Creation focus more strongly on the user, lead more quickly to market launch and are less likely to fail in terms of the expected business value in context of Banking IT Services.

Links

http://blog.standishgroup.com; CHAOS report

http://www.sbs.ox.ac.uk/research/people/Pages/BentFlyvbjerg.aspx

http://designthinking.ideo.com